Your Company Purchased a Twelve-month Insurance Policy

One month corresponds to 2000 24000 x 112 in insurance policy. An analysis of the companys insurance policies provided the following facts.

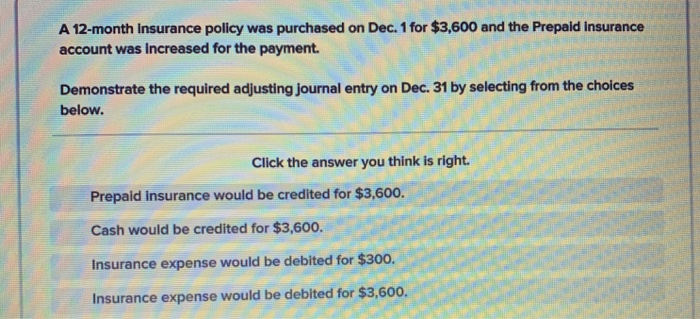

Solved Karla Tanner Opens A Web Consulting Business Called Chegg Com

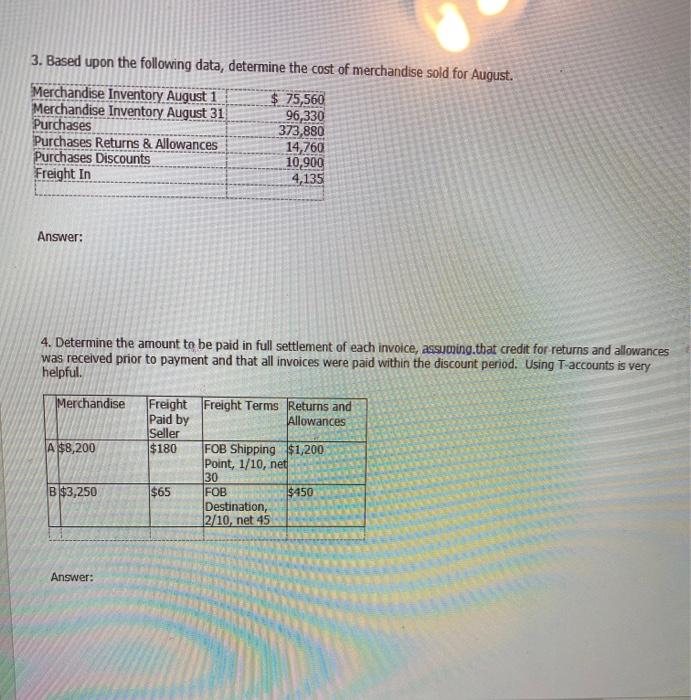

For example if you purchase 12 months of insurance divide your lump sum payment by 12 to determine the cost of one months insurance premium.

. A company purchased a two-year fire insurance policy on May 1 2012. Your company purchased a twelve-month insurance policy for 36000 in January. The company has adopted a 12-month accounting.

Start by contacting these insurance companies to ask if youre eligible to receive 12-month auto insurance quotes. The initial journal entry for Company A would be as follows. The company has earned but not recorded 1000 of interest from investments in CDs for the year ended December 31 201 3.

Several auto insurance companies offer 12-month policies. On March 1 2003 a company paid a 16200 premium on a 36-month insurance policy for coverage beginning on that date. Debit Accrued Payables 3000 Credit Insurance Expense 3000 d.

The transaction was recorded with an 1800 debit to Prepaid Insurance. There are exceptions Radov says such as the Maryland Automobile Insurance Fund that offers 12-month policies and caters to high-risk drivers. An analysis of insurance policies shows that 2000 of unexpired insurance benefits remain at December 31 201 3.

Whats the entry to record the monthly insur. Debit Insurance Expense 3000 Credit Accrued Liabilities 3000 b. The company pays 24000 in cash upfront for a 12-month insurance policy for the warehouse.

Assuming no previous adjusting entries have been made what adjusting entry should be made at March 31 2004 for the interim financial statements to be properly stated. QUESTION 1216 Your company purchased a twelve-month insurance policy for 36000 in January. Credit to Prepaid insurance for 400.

Up to 256 cash back Get the detailed answer. MicroTrain Company purchased for cash an insurance policy on its trucks for the 12 month period beginning December 1. Debit Insurance Expense 3000 Credit Prepaid Insurance 3000 c.

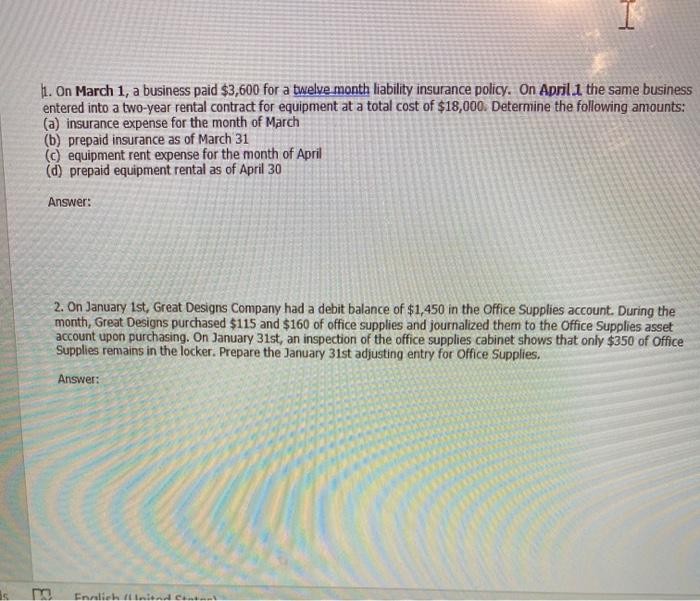

The journal entry made on December 1 to record the purchase of the policy is illustrated in the following table remember when we pay for expenses in advance we record them as an asset. Accounting questions and answers. A 12-month insurance policy was purchased on Dec.

For example if you spend 1200 for the 12-month policy your monthly cost is 100. In 2008 Progressive Insurance was accused by the Massachusetts Association of Insurance Agents of not offering 12-month policies. Therefore prepaid insurance must be adjusted.

Check 2005 insurance expense. Advantages to purchasing a 12-month paid-in-full policy. Whats the entry to record the monthly insurance expense in March.

At the end of one month Company A would have used up one month of its insurance policy. 300 is reported as a expense and 900 is reported as a liability 300 is reported as a expense and 900 is reported as an asset 1200 is reported as an asset. 1 for 4800 and the Prepaid insurance account was initially increased for the payment.

The required adjusting journal entry on December 31 includes a. The Prepaid Insurance account had a 5000 balance on December 31 201 2. Check all that apply debit to Insurance expense for 400.

You will not forget to pay mid-way through the year. 1216- Your company purchased a twelve-month insurance policy for 36000 in January. 3 on a question A company purchased a 12 month insurance policy on October 1 for 1200.

View full document. Click the answer you think is right. The following transactions were completed by the company during the.

Whats the entry to record the monthly insurance expense in March. On the December 31 annual financial statements. On September 1 2017 the company purchased a 12-month insurance policy for 1800.

Refer to that policy and fill in the blanks in the following table. The 2400 payment was recorded on December 1 with a debit to the income statement account Insurance Expense and a credit to the current asset Cash. 1216- Your company purchased a twelve-month insurance policy for 36000 in.

On the December 31 annual financial statements. A company purchased a 12 month insurance policy on October 1 at a cost of 1200. On December 1 your company paid its insurance agent 2400 for the annual insurance premium covering the twelve-month period beginning on December 1.

Up to 25 cash back A company paid for a 12-month insurance policy on February 1 2004 for 3600 and debited the Prepaid Insurance account for the cost of the policy. Typically you also can earn a discount on your car insurance costs if you opt for a 12-month auto insurance policy and agree to pay the full year of premium costs upfront. It paid the 2400 premium in cash on the same date and recorded the entry with a debit to Prepaid Insurance for 2400.

Calculate your monthly premium cost. Your insurance rate will be locked in and cannot change in 2013 car insurance rates increased nationwide by 153 One single bill for the entire year. Policy Date of purchase Month of coverage Cost A April 1 2012 24 6000 B April 1 2013 36 7200 C.

State regulations may also require 12-month options. On December 29 2017 the company completed a 7000 service that has not billed or recorded as of December 31 2017. SELECT ONLY ONE Debit Accrued Payables 3000 Credit Insurance Expense 3000 Debit Insurance Expense 3000 Credit Cash 3000 Debit Prepaid Insurance 3000 Credit Insurance.

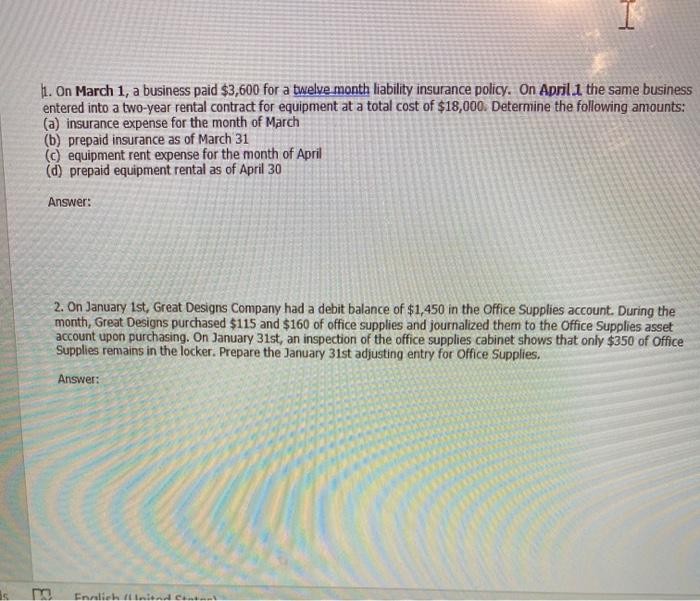

Solved H On March 1 A Business Paid 3 600 For A Twelve Chegg Com

Solved A 12 Month Insurance Policy Was Purchased On Dec 1 Chegg Com

Solved H On March 1 A Business Paid 3 600 For A Twelve Chegg Com

Comments

Post a Comment